How to Calculate How Much Money You Need for Retirement is one of the most important financial questions you will ever ask. Without a clear number, retirement planning becomes guesswork. With the right calculation, you gain clarity, confidence, and control over your financial future.

Many people delay retirement planning because it feels overwhelming. In reality, breaking the process into simple steps makes it manageable and effective. This guide explains how to calculate how much money you need for retirement using realistic assumptions and proven strategies.

Why Knowing Your Retirement Number Is Critical

Retirement is not just about stopping work. It is about maintaining your lifestyle without running out of money. Knowing your retirement number helps you:

• Set realistic savings goals

• Choose the right investment strategy

• Avoid unnecessary financial stress later in life

If you skip this step, you risk saving too little or over-sacrificing today. Learning How to Calculate How Much Money You Need for Retirement gives you balance.

Step 1: Estimate Your Annual Retirement Expenses

The foundation of retirement planning is understanding your future expenses. Start by estimating how much money you will need each year in retirement.

Core Expense Categories

Housing, food, utilities, transportation, healthcare, insurance, and personal spending form the core of most retirement budgets.

Some expenses may decrease after retirement, such as commuting costs. Others, like healthcare, often increase.

For a realistic breakdown, this guide on

retirement expenses planning provides helpful benchmarks.

Step 2: Apply the 70–80% Rule Carefully

A common rule of thumb suggests retirees need about 70–80% of their pre-retirement income each year. While useful, this is only a starting point.

Your personal lifestyle matters more than averages. If you plan to travel often or support family members, your required income may be higher.

This is why learning How to Calculate How Much Money You Need for Retirement requires personalization, not assumptions.

Step 3: Decide How Long Your Retirement May Last

Longevity is one of the biggest unknowns in retirement planning. Many people underestimate how long they will live.

If you retire at 65, planning for 25–30 years of income is reasonable. Planning for a longer life reduces the risk of running out of money.

The Social Security Administration offers useful data on

life expectancy statistics that can help you estimate retirement length.

Step 4: Calculate Your Total Retirement Savings Goal

Once you know your annual expenses and retirement length, you can calculate your total retirement goal.

For example, if you need $50,000 per year and plan for 30 years, you will need approximately $1.5 million, excluding inflation and investment returns.

This number may seem large, but it becomes achievable through long-term investing and consistent contributions.

Step 5: Account for Inflation

Inflation reduces purchasing power over time. Ignoring it is one of the most common retirement planning mistakes.

A modest inflation rate can significantly increase future expenses. Adjusting your calculations ensures your retirement income keeps pace with rising costs.

This article on

retirement savings calculation explains inflation-adjusted planning clearly.

Step 6: Estimate Investment Returns Conservatively

Your investments play a key role in how much money you need to save. However, overly optimistic return assumptions can be dangerous.

Using conservative estimates helps protect your plan from market volatility. Diversified portfolios often provide more stable long-term results.

Understanding this balance is essential when learning How to Calculate How Much Money You Need for Retirement.

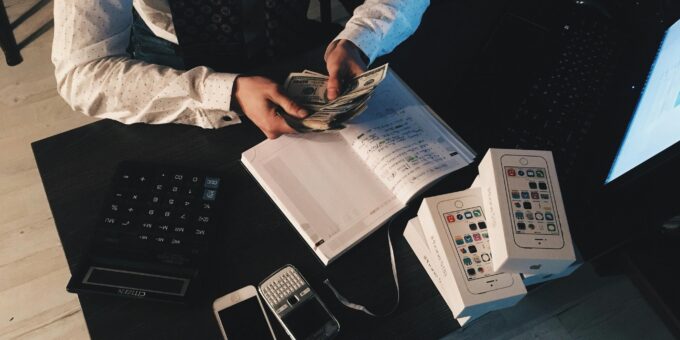

Step 7: Include Guaranteed and Passive Income Sources

Not all retirement income must come from savings. Many retirees receive income from Social Security, pensions, or annuities.

In addition, building passive income streams before retirement can reduce the amount you need to save.

Some individuals create online business models such as affiliate marketing or a dropshipping business. Understanding affiliate vs dropshipping helps evaluate which income stream aligns with your skills and risk tolerance.

While these methods require effort upfront, they can supplement retirement income later.

Step 8: Use Retirement Calculators as a Reference

Online retirement calculators provide useful estimates, but they should not replace thoughtful planning.

Use calculators to test different scenarios. Adjust assumptions for inflation, retirement age, and lifestyle.

Combining tools with personal analysis produces more reliable results.

Step 9: Stress-Test Your Retirement Plan

Life rarely goes exactly as planned. Stress-testing your plan helps you prepare for uncertainty.

Consider scenarios such as market downturns, unexpected medical costs, or delayed retirement.

Building flexibility into your strategy increases long-term success.

Step 10: Review and Adjust Your Retirement Number Regularly

Your retirement number is not permanent. Income changes, family needs evolve, and goals shift over time.

Review your plan annually. Increase contributions when income rises. Adjust expectations when necessary.

Our internal resource on

retirement planning strategy explains how to refine your plan as life changes.

Common Mistakes When Calculating Retirement Needs

Many people underestimate healthcare costs, ignore inflation, or assume unrealistic investment returns.

Another mistake is relying solely on savings without exploring income diversification.

A well-rounded approach produces more accurate and sustainable results.

Final Thoughts on How to Calculate How Much Money You Need for Retirement

How to Calculate How Much Money You Need for Retirement is not about finding a perfect number. It is about creating a realistic framework that guides your decisions.

By estimating expenses, accounting for inflation, planning for longevity, and exploring income sources, you build confidence in your financial future.

The earlier you calculate your retirement needs, the easier it becomes to achieve them.